Business Insurance in and around Austin

Get your Austin business covered, right here!

Helping insure businesses can be the neighborly thing to do

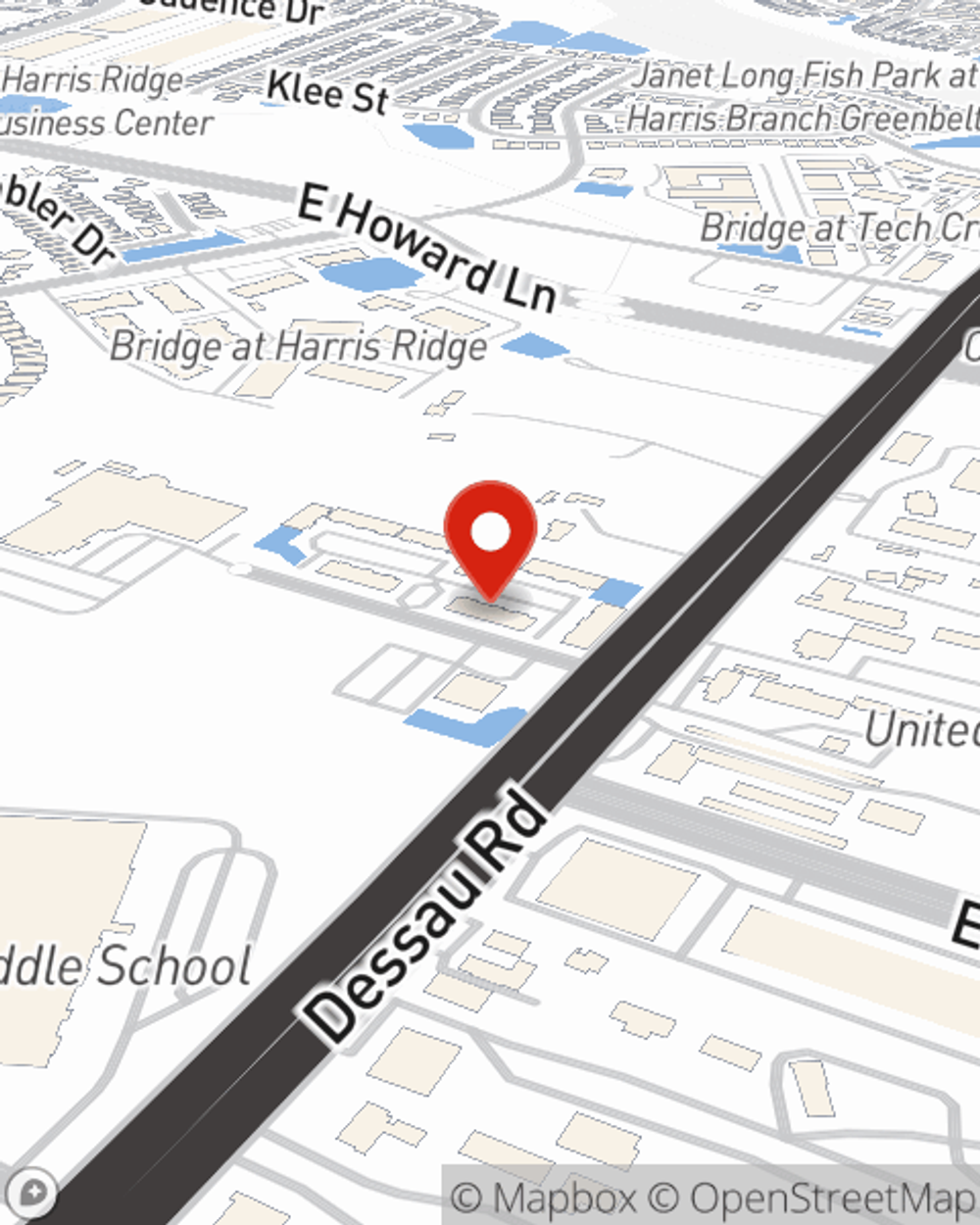

- Austin

- Elgin

- Round Rock

- Georgetown

- Dallas

- San Antonio

- Houston

- Bastrop

- Pflugerville

- Manor

- Cedar Park

- Taylor

- Leander

Coverage With State Farm Can Help Your Small Business.

When experiencing the highs and lows of small business ownership, let State Farm do what they do well and help provide great insurance for your business. Your policy can include options such as business continuity plans, errors and omissions liability, and a surety or fidelity bond.

Get your Austin business covered, right here!

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's an arts and crafts store, an ice cream shop, or a farm supply store, having the right protection for you is important. As a business owner, as well, State Farm agent Robert Ndegwa understands and is happy to offer exceptional service to fit the needs of you and your business.

Call or email agent Robert Ndegwa to explore your small business coverage options today.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Robert Ndegwa

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.